The House: Unclear Lines, Clear Expectations

A Commentary By Kyle Kondik

Redistricting delays cloud the seat-by-seat picture, but midterm history suggests a Republican edge.

KEY POINTS FROM THIS ARTICLE

— Delays in the redistricting process mean that we won’t be releasing Crystal Ball House district ratings for the foreseeable future.

— However, midterm history along with GOP advantages in redistricting make the Republicans clear, though not certain, favorites to win the House next year.

— Recent midterm history helps illustrate some of the Democratic vulnerabilities if this cycle breaks against the White House, as it did in the past four midterms.

The presidential party’s persistent midterm struggles

So far this year, the Crystal Ball has released its initial ratings for the 2022 Senate races and the 2021-2022 gubernatorial races. We’re holding off on House ratings, though, because this is a national redistricting cycle. Without district lines in place, there’s no sense in issuing specific ratings.

The redistricting process is also going to be significantly later this cycle. The U.S. Census Bureau has delayed the release of the granular population data that the states use to draw new districts until Sept. 30. So we won’t start seeing new districts until the fall, at the earliest. Just to put that in perspective, by late September 2011, several big states, such as California, Illinois, Michigan, and Ohio, had already completed their maps.

We know that Republicans will control the line drawing in more places than Democrats. Based on an analysis of state-by-state redistricting procedures by Justin Levitt’s All About Redistricting site, and taking into account anticipated House seat gains and losses because of population changes, Republicans control the process in states that are expected to hold 188 seats and Democrats have control in states expected to hold 73. The remaining 174 seats are in states where neither party dominates, where the process is nonpartisan or bipartisan, or where there is only a single House seat.

Among the big states, Republican redistricting power will likely be most significant in Florida, Georgia, North Carolina, and Texas, while Democrats will hope to bolster themselves in Illinois and New York. There will be a lot more to say about redistricting as the cycle unfolds.

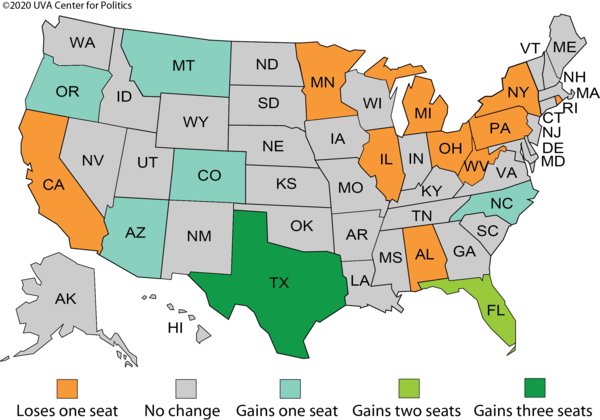

Map 1 shows the states that are likely to gain or lose House seats following the census based on an analysis by Dudley Poston and Teresa Sullivan for the Crystal Ball last year.

Map 1: Projected House seat gains/losses following 2020 census

Even setting aside likely GOP advantages in the gerrymandering wars, history points to Republicans in the House.

In midterm elections, the president’s party typically struggles, at least to some degree. Since the Civil War, there have been 40 midterm elections. The party that held the White House lost ground in the House in 37 of those elections, with an average seat loss of 33. Since the end of World War II, the average seat loss is a little smaller — 27 — but still significant.

As Andrew Busch wrote in his history of midterm elections, Horses in Midstream, “the midterm election pattern virtually guarantees that the president’s party will be hurt at regular intervals. The extent of that damage may vary considerably, but the fact of it rarely does.” Midterms provide an opportunity for voters to put a check on the White House, and voters very often take that opportunity accordingly.

In 2020, Democrats won a 222-213 majority in the House, meaning that Republicans only need to net five seats to win the majority this year. Just based on history, it would be a surprise if the Democrats kept their majority. Perhaps some confluence of factors — such as an economic boom, President Biden maintaining an approval rating north of 50%, redistricting not going the way Republicans hope, Republican infighting that depresses GOP turnout, and more — could lead to Democrats holding the House. But the bottom line is that Republicans winning the House next year would be an outcome easily foreseeable based on familiar American political patterns, whereas the Democrats holding the majority would be an outcome requiring a special explanation.

The recent midterm pattern

Let’s say, for the sake of argument, that 2022 is not an exception, and that the midterm breaks against the White House. What might we expect? Data from the last four midterms provide some clues.

Back in 2017, we compared how the presidential party performed in House races conducted during the presidential year versus the following midterm year in the 2004-2006, 2008-2010, and 2012-2014 cycles. We looked only at districts that 1) Featured both a Democratic and Republican candidate in both the presidential year and the midterm year and that 2) Were not redrawn between the presidential and the midterm year. In order to normalize results across the election cycles, we just looked at the two-party vote. For this analysis, we also added the 2016-2018 results — for more on how we determined whether to include or exclude a district, see the footnote at the end of this article.[1]

Across the four election cycles, there were 1,325 individual races that met the criteria to be included in our analysis. On average, the presidential party’s share of the two-party vote declined about five points (5.1 to be exact) from the presidential year to the midterm. That’s enough to turn a 55%-45% victory in the presidential year for a candidate sharing the party label of the person elected president to effectively a 50%-50% tie in the succeeding midterm.

The average presidential penalty varied from cycle to cycle. It was 4.6 points in both the 2004-2006 and 2016-2018 cycles — both cycles where Democrats flipped the House two years after Republicans won the White House. In 2008-2010, the penalty was a larger 7.5 points as Republicans flipped the House two years after a Democrat won the presidency, while in 2012-2014 it was a more modest 3.5 points as Republicans held the House in both elections.

Part of what can impact the shift from presidential to midterm is how different the political environment was in the presidential versus the midterm year. The Democrats had one of their best elections ever in 2008, and then the Republicans roared back in 2010. In the other three cycles examined, the presidential election year was more competitive, making the midterm shift less pronounced.

We can go a bit deeper by looking at four categories of seats: seats defended by presidential party incumbents in midterms, seats defended by non-presidential party incumbents, open seats defended by the presidential party, and open seats defended by the non-presidential party. But before we do, let’s once again offer an important caveat: These races all compare presidential year to midterm results in districts that did not change from the presidential year to the midterm year. Almost all districts will change between 2020 to 2022, if only to incorporate changes in population, and some districts will change a lot or even be eliminated entirely. So keep that in mind as we look at these four types of districts over the last four midterms:

— Of the 1,325 races in our collection of results, roughly half (659) featured presidential party incumbents. On average, their performance fell by six percentage points from the presidential year to the midterm, or 12 points in terms of margin. Just to put that in perspective, 44 House Democrats won by 12 points or fewer in 2020. That’s not to say all, most, or even some of these Democratic incumbents are doomed to lose in 2022. But they are potentially vulnerable in a midterm that breaks against the White House, depending on redistricting, opponents, and other factors.

— Another large chunk of races, 521, featured incumbents from the non-presidential party. Those incumbents, on average, ran 3.9 points better in the midterm compared to the preceding presidential election. Only three of these incumbents lost: then-Reps. Steve Southerland (R, FL-2) and Lee Terry (R, NE-2) in 2014 — both of whom undermined their reelection bids with self-inflicted problems — and then-Rep. Charles Djou (R, HI-1) in 2010. Djou won a flukish special election victory that May: He benefited from a Democratic split in an all-party election format but was unable to defend the heavily Democratic seat in the regular November election. No Democratic incumbents lost in either the 2006 and 2018 midterm. This is potentially good news for some new Republican incumbents, a handful of whom won by extremely close margins in 2020.

— There were 65 open seats defended by the nonpresidential party. On average, there was hardly any change from the presidential year to the midterm year in these seats, with the nonpresidential party gaining a negligible 0.2 points on average. Just three such seats changed hands over the last four midterms: Democrats flipped Delaware’s open and heavily Democratic at-large seat in 2010 after popular then-Rep. Mike Castle (R) ran for Senate (and proceeded to lose to fringe candidate Christine O’Donnell in the primary), and Republicans flipped two open Minnesota House seats in 2018, MN-1 and MN-8, that Donald Trump won by double digits in both 2016 and 2020.

— And there were 80 open seats defended by the president’s party. These kinds of seats often end up as the best targets for the nonpresidential party in midterms: Close to half of them, 35, flipped to the nonpresidential party, and the presidential party lost an average of 9.9 points of voteshare in these districts from the presidential to the midterm (or about 20 points in terms of two-party margin). Just two Democrats have retired so far this cycle, but based on this recent history, both districts could be Republican targets: Rep. Ann Kirkpatrick (D, AZ-2) won by about 10 points in a district that Biden won by roughly the same amount, and Rep. Filemon Vela (D, TX-34) won by about 13.5 points in a district that Biden won by just four. Biden performed poorly across several South Texas districts — Hillary Clinton carried TX-34 by 21.5 points in 2016. Redistricting could change these districts markedly, particularly TX-34: Republicans may dramatically alter the South Texas districts in order to capitalize on new Democratic weakness in the region, although it’s also possible that Republican gains in the region won’t endure in the long term.

Conclusion

It’s far too early to make any hard and fast predictions about the House, particularly with all of the uncertainties about redistricting. But the history is what it is, and if the 2022 midterm unfolds like the last several, Republicans are well-positioned to win the House next year. In midterm environments, the president’s party typically loses ground, particularly in open seats, while the nonpresidential party typically gains ground and is able to defend its open seats.

Footnote

[1] Here’s how we decided which races to include: For each of the four presidential-to-midterm comparisons, any district that was uncontested by one of the two major parties in either election was excluded. We also excluded elections in states that use a “top-two” system (California and Washington) in which two members of the same party advanced to the November election. Districts that were redistricted between the presidential election and the midterm were also discarded, meaning that all of Georgia’s results and a handful of Texas districts are excluded from the 2004-2006 analysis because those states used different maps in those two elections. Pennsylvania was excluded from the 2016-2018 analysis because that state redistricted between those two elections. Finally, we did not include any results from Louisiana because of its unique, November “jungle” primary system that sometimes produces December runoffs. Understandably, this culled hundreds of races from our four-midterm study, but we still ended up with 1,325 total races over four time periods: 316 in 2004-2006, 357 in 2008-2010, 328 in 2012-2014, and 324 in 2016-2018. Our decision to exclude Louisiana from our study removes one of the rare losses for a non-presidential party incumbent in a recent midterm. In 2008, Joseph Cao (R) narrowly defeated indicted then-Rep. William Jefferson (D, LA-2) in a heavily Democratic seat based in New Orleans. Two years later, Cao suffered a lopsided loss. The data we used are from Gary Jacobson and Daily Kos Elections.

Kyle Kondik is a Political Analyst at the Center for Politics at the University of Virginia and the Managing Editor of Sabato's Crystal Ball.

See Other Political Commentary by Kyle Kondik.

See Other Political Commentary.

This article is reprinted from Sabato's Crystal Ball.

Views expressed in this column are those of the author, not those of Rasmussen Reports. Comments about this content should be directed to the author or syndicate.

Rasmussen Reports is a media company specializing in the collection, publication and distribution of public opinion information.

We conduct public opinion polls on a variety of topics to inform our audience on events in the news and other topics of interest. To ensure editorial control and independence, we pay for the polls ourselves and generate revenue through the sale of subscriptions, sponsorships, and advertising. Nightly polling on politics, business and lifestyle topics provides the content to update the Rasmussen Reports web site many times each day. If it's in the news, it's in our polls. Additionally, the data drives a daily update newsletter and various media outlets across the country.

Some information, including the Rasmussen Reports daily Presidential Tracking Poll and commentaries are available for free to the general public. Subscriptions are available for $4.95 a month or 34.95 a year that provide subscribers with exclusive access to more than 20 stories per week on upcoming elections, consumer confidence, and issues that affect us all. For those who are really into the numbers, Platinum Members can review demographic crosstabs and a full history of our data.

To learn more about our methodology, click here.