The Missing 'Humanity Clause' at Bain

A Commentary by Froma Harrop

During the Great Depression, my father toiled in a box factory. The workers were all flat broke, he recalled, and desperate for every nickel. But when overtime hours appeared, the men made sure they went to a guy with kids. The laborers were obeying the unwritten and unenforceable "humanity clause," whereby one gives up some personal gain in deference to another's screaming need.

My father later built a prosperous small business and became a reliable Republican (until the Bill Clinton impeachment). But he never saw working people as nobodies. Profits, while important, were not all.

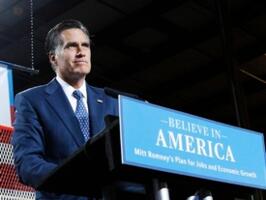

A lack of similar empathy is what many find most disquieting about Mitt Romney, whose private-equity firm pumped his fortune to perhaps $250 million. It's more than just the nature of the business. It was a certain inhumanity of the Bostonians running Bain Capital, namely Mitt.

Private equity executives argue that by wringing costs out of the companies they buy, the firms emerge stronger. They often save ailing businesses for the good of the workers, as well as the investors.

Critics say such investors often loot companies. They slash workforces, pile on debt and enrich the partners, leaving the weakened patient to die. Bain excelled at these leveraged buyouts. A steel mill in Kansas City serves as a vivid example, as Reuters reports.

Under Romney's leadership, Bain bought majority control of Worldwide Grinding Systems in 1993. It put up $8 million of the $75 million purchase price and borrowed $125 million by issuing bonds. In business since 1888, the mill was renamed GS Technologies. Bain immediately sent investors $36 million in dividend checks.

"Paying distributions with debt is not uncommon," Duke University finance professor Campbell Harvey told Reuters. "The only thing that strikes me as a bit unusual is the size of the dividend. There would be logic in them saving some cash for a downturn."

A steel business is capital-intensive and sensitive to economic conditions. That's why it needs to conserve money for the lean years. When the economy did go south, so did GS Technologies. Its bean-counters reportedly started skimping on everything from earplugs to basic maintenance of equipment.

GS Technologies went bankrupt in 2001, the plant closed, and 750 workers lost their jobs. Bain skipped out on a previous agreement to provide severance pay and health coverage if that happened. The workers saw their pensions slashed by up to $400 a month.

But Bain walked away from the smoking ruins $12 million richer, not including $4.5 million in consulting fees. And it had tapped government, as well. The company had extracted $3 million in tax savings from Kansas City and partook of a federal program putting taxpayer guarantees on loans to troubled steel companies. The federal Pension Benefits Guarantee Corp. bailed out the company's underfunded pension plan to the tune of $44 million.

Bain blamed the company's failure on an economic downturn and cheaper steel imports. The company's former CEO Roger Regelbrugge blamed burdensome debt and new managers from outside the steel industry. "I have no question that the company would have survived under different management," he said.

The moral here is that there was no morality. In normal business, companies do fail, and layoffs sometimes must happen. But after feasting off the company, Bain had the means to keep its word to the workers. That should have been a matter of honor.

I don't think Romney took sadistic pleasure in firing the machinists and pipefitters. Possibly worse, he never saw them as human beings -- but as potential subtraction to his personal bottom line. They never registered with him one way or another.

COPYRIGHT 2012 THE PROVIDENCE JOURNAL CO.

DISTRIBUTED BY CREATORS.COM

See Other Political Commentary.

See Other Commentaries by Froma Harrop.

Views expressed in this column are those of the author, not those of Rasmussen Reports. Comments about this content should be directed to the author or syndicate.

Rasmussen Reports is a media company specializing in the collection, publication and distribution of public opinion information.

We conduct public opinion polls on a variety of topics to inform our audience on events in the news and other topics of interest. To ensure editorial control and independence, we pay for the polls ourselves and generate revenue through the sale of subscriptions, sponsorships, and advertising. Nightly polling on politics, business and lifestyle topics provides the content to update the Rasmussen Reports web site many times each day. If it's in the news, it's in our polls. Additionally, the data drives a daily update newsletter and various media outlets across the country.

Some information, including the Rasmussen Reports daily Presidential Tracking Poll and commentaries are available for free to the general public. Subscriptions are available for $4.95 a month or 34.95 a year that provide subscribers with exclusive access to more than 20 stories per week on upcoming elections, consumer confidence, and issues that affect us all. For those who are really into the numbers, Platinum Members can review demographic crosstabs and a full history of our data.

To learn more about our methodology, click here.