Discover (R) Consumer Spending Monitor (SM)

Consumer Confidence Declines in June

Consumer confidence in the economy and personal finances, which are key economic indicators, worsened in June to the lowest levels since January 2012. The Discover U.S. Spending Monitor, a 5-year-old daily poll tracking economic confidence and spending intentions of nearly 8,200 consumers throughout the month, declined 4.8 points to 90.7 in June.

Economic Expectations Weaken

The percentage of respondents who view the U.S. economy as improving dropped 4 percentage points to 29 percent in June. At the same time, 53 percent of consumers now rate the U.S. economy as poor, which is an increase of 3 percentage points from the prior month and the highest level since January 2012. Half of women now expect the economy to get worse, up 4 percentage points from last month; only 48 percent of men expect the same economic trend, and this remains unchanged from the prior month.

Personal Finances Worsen

Consumer sentiment about personal finances declined in June compared to May.

Consumers rating their finances as fair remained at 40 percent. However, those who view their finances as excellent or good was 4 percentage points lower at 33 percent while those who view their finances as poor increased 2 percentage points to 24 percent. Consumers who anticipate their personal finances getting worse increased 4 percentage points to 47 percent. The percent of parents with kids at home who believe their personal finances will get worse increased 8 percentage points to 48 percent and, for 18 to 39-year olds, there was a 6 percentage point increase to 44 percent.

Spending Intentions Flat to Lower for the Next Month

Consumers' declining confidence in the economy and their personal finances is affecting their spending intentions as well. While half of respondents plan to spend about the same next month, those expecting to spend more dropped 4 percentage points to 25 percent.

Expectations for lower spending on home improvements increased 4 percentage points from the prior month to 48 percent. Nearly 47 percent of consumers expect to spend less on discretionary purchases like going out to dinner or the movies. However, those expecting to spend more held steady at 12 percent. More consumers expect spending on major personal purchases, like vacations, in the next month to be lower, with a 6-point increase to 48 percent.

About Discover U.S. Spending Monitor

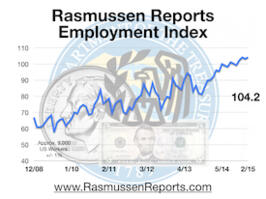

The Discover U.S. Spending Monitor(SM)is a monthly index of consumer spending intentions and capacity that is based on interviews with a random sample of 8,200 U.S. adults conducted at a rate of 275 per night. In addition to spending, the survey asks consumers their opinions on the U.S. economy and their personal finances. The Monitor began in May 2007 with a base index of 100. Surveys are conducted by Rasmussen Reports, an independent survey research firm ( http://www.rasmussenreports.com ).

The Discover Spending Confidence Monitor, being released once a month, queried 8,200 adult consumers in June 2012 on spending intentions and capacity. The survey also asked for opinions on the U.S. economy and ratings of personal finances. The survey was conducted by Rasmussen Reports, LLC. It has a margin of error of +/- 1 percent.

Rasmussen Reports is a media company specializing in the collection, publication and distribution of public opinion information.

We conduct public opinion polls on a variety of topics to inform our audience on events in the news and other topics of interest. To ensure editorial control and independence, we pay for the polls ourselves and generate revenue through the sale of subscriptions, sponsorships, and advertising. Nightly polling on politics, business and lifestyle topics provides the content to update the Rasmussen Reports web site many times each day. If it's in the news, it's in our polls. Additionally, the data drives a daily update newsletter and various media outlets across the country.

Some information, including the Rasmussen Reports daily Presidential Tracking Poll and commentaries are available for free to the general public. Subscriptions are available for $4.95 a month or 34.95 a year that provide subscribers with exclusive access to more than 20 stories per week on upcoming elections, consumer confidence, and issues that affect us all. For those who are really into the numbers, Platinum Members can review demographic crosstabs and a full history of our data.

To learn more about our methodology, click here.