Country Financial Security Index

Americans More Optimistic About Their Financial Security In August

Americans are feeling better about their finances this month than one year ago when their confidence hit an all-time low, according to the COUNTRY Financial Security Index®. The Index inched up 0.8 points to 65.9 in August after slipping 1.1 points in June. This comes exactly one year after the Index reached its lowest reading ever at 62.4. This uptick in confidence also marks the first August increase since 2008 and the highest August Index reading since that year.

Americans were more optimistic about their financial security by every measure. The biggest gains were in long-term financial goals.

Those who feel they have enough resources to send their children to college jumped seven points to 61 percent.

Another 58 percent are confident in their ability to retire comfortably, up three points.

Further, one in five (20 percent) feel their level of financial security is improving, up two points to the highest level ever. Fifty-two percent were able to save, up one point from June and 10 points from a year ago. Throughout 2012, at least half of Americans have been able to save. This is the first time savings have remained consecutively at 50 percent or higher since 2008.

"We are used to a seasonal dip in confidence in June and August, so it's refreshing to see financial optimism this month," said Joe Buhrmann, manager of financial security support at COUNTRY Financial. "Americans have made great strides this year, especially in their ability to set aside money. To maintain this positive momentum, remember to plan ahead and set aside savings for any unexpected obstacles that might set you back."

For a look back at Americans' financial concerns last August and insight into what's changed, watch a video interview with Joe Buhrmann at www.countryfinancialsecurityindex.com .

Men, Gen Y have sunnier financial outlooks When it comes to financial security, men were more optimistic than women this month.

The number of men confident they have the resources to send their children to college is up 13 points (68 percent). Just 56 percent of women said the same. However, women's confidence is up three points from June.

More men were able to save this month than women (55 percent vs. 48 percent). For men, this number is up five points while women dropped four points.

Eighteen to 29 year olds were the most optimistic overall of any age group.

Forty-nine percent rated their overall level of financial security positively. This is a 15-point increase and at least six points higher than other age groups.

There was a 12-point jump to 73 percent in those that feel they will have the financial resources to send their children to college. This is at least 14 points higher than all other age groups.

"Younger adults are staying optimistic despite some unsettling economic news recently," said Buhrmann. "With long-term goals like retirement and college funding further away, they're making the most of that time by saving early. However, no matter your age, you need a financial plan to reach your goals."

To access embeddable data charts and video interviews about the latest COUNTRY Index data, please visit www.countryfinancialsecurityindex.com . Individuals can also learn more and compare their own results with the national COUNTRY Financial Security Index. The next COUNTRY Financial Security Index will be released October 16, 2012 and subsequently every other month.

The COUNTRY Financial Security Index

The COUNTRY Financial Security Index(R) is a bi-monthly measure of Americans' sentiments toward their overall financial security. It is an aggregate of various factors comprising financial security including savings and investments, financial planning, retirement, education and asset protection.

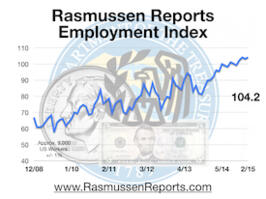

The COUNTRY Index was created by COUNTRY Financial and is compiled by Rasmussen Reports, LLC, an independent research firm, based on a national telephone survey of at least 3,000 Americans.

The margin of sampling error for a survey based on this many interviews is approximately +/- 2 percentage points with a 95 percent level of confidence.

About COUNTRY

COUNTRY Financial (http://www.countryfinancial.com) serves about one million households and businesses throughout the United States. It offers a full range of financial products and services from auto, home and life insurance to retirement planning services, investment management and annuities.

The national telephone survey of 3,000 Adults was conducted by Rasmussen Reports July 2012. The margin of sampling error for the survey is +/- 2 percentage points with a 95% level of confidence (see methodology).

Rasmussen Reports is a media company specializing in the collection, publication and distribution of public opinion information.

We conduct public opinion polls on a variety of topics to inform our audience on events in the news and other topics of interest. To ensure editorial control and independence, we pay for the polls ourselves and generate revenue through the sale of subscriptions, sponsorships, and advertising. Nightly polling on politics, business and lifestyle topics provides the content to update the Rasmussen Reports web site many times each day. If it's in the news, it's in our polls. Additionally, the data drives a daily update newsletter and various media outlets across the country.

Some information, including the Rasmussen Reports daily Presidential Tracking Poll and commentaries are available for free to the general public. Subscriptions are available for $4.95 a month or 34.95 a year that provide subscribers with exclusive access to more than 20 stories per week on upcoming elections, consumer confidence, and issues that affect us all. For those who are really into the numbers, Platinum Members can review demographic crosstabs and a full history of our data.

To learn more about our methodology, click here.